Monarch: The Ideal Alternative to Mint for My Financial Management

In March 2024, Intuit discontinued its free budgeting app, Mint, by integrating it with Credit Karma. Unfortunately, not all of Mint’s best features survived this transition, prompting many users to search for a suitable alternative. After testing various options, I ultimately chose Monarch, which retains my favorite Mint features while introducing exciting new functionalities that simplify budgeting.

Why I Loved Mint

I was introduced to Mint through my financial coach. What drew me to Mint was its free usage, a significant advantage as I sought ways to reduce costs. Within months of using the app, I developed a fondness for several of its standout features.

- User-Friendly Interface: Mint’s intuitive and easily navigable interface made it highly accessible, allowing me to quickly understand how to use the app effectively.

- All-in-One Financial Overview: Mint enabled me to connect all my financial accounts, including bank accounts, credit cards, loans, and investments, providing a comprehensive snapshot of my finances and their alignment with my goals.

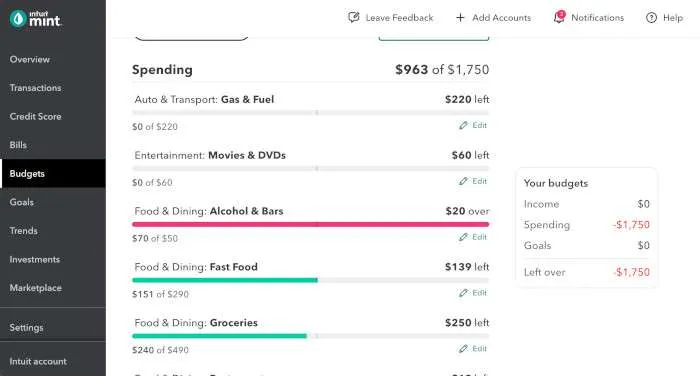

- Customizable Budgets: Mint allowed me to create tailored budgets for various spending categories such as groceries and travel, tracking my expenses and alerting me when I was nearing my budget limits.

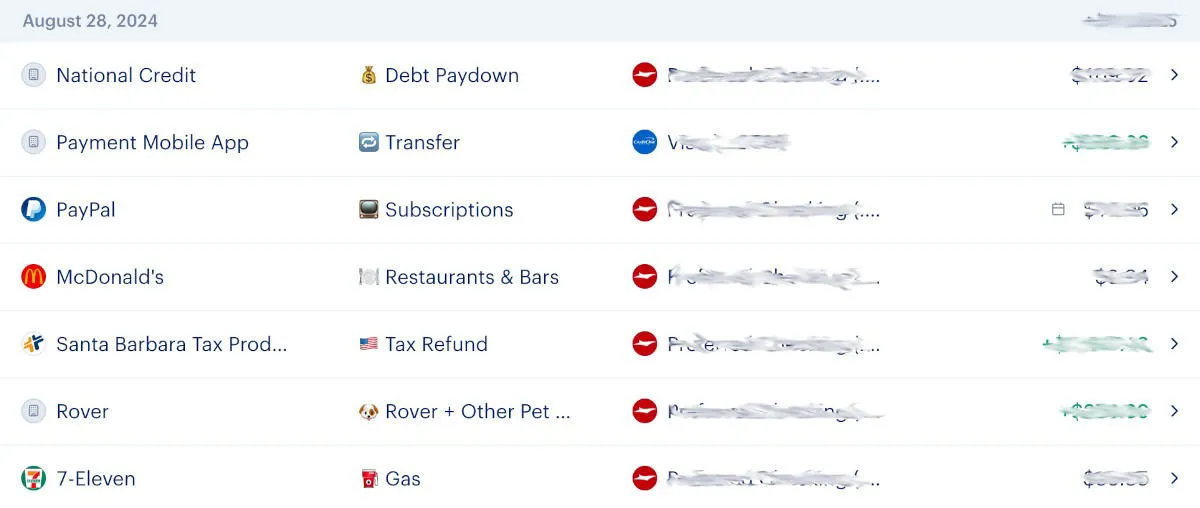

- Automatic Transaction Categorization: With Mint, transactions were automatically categorized, and I could set rules for recurring expenses, saving time and granting insights into my spending behavior.

- Zero-Based Budgeting: Mint supported zero-based budgeting, allowing me to allocate every dollar I earned each month, including savings.

As I began searching for a Mint alternative, my goal was to find the best budgeting app that mirrored my favorite Mint features. I found that Monarch offered all I desired and even more.

Total Customization

Monarch excels in customizations within its user-friendly interface. After a couple of weeks of exploring, I discovered the extensive customization options available, and even after months of usage, I have yet to fully maximize its capabilities.

With the Monarch app, I can add an unlimited number of accounts, including checking accounts, high-yield savings, health savings accounts, credit cards, and loans. This provides me with an instantaneous overview of my net worth and available funds. Additionally, this comprehensive information enhances my use of the Goal Setting feature, allowing me to track my monthly progress effectively.

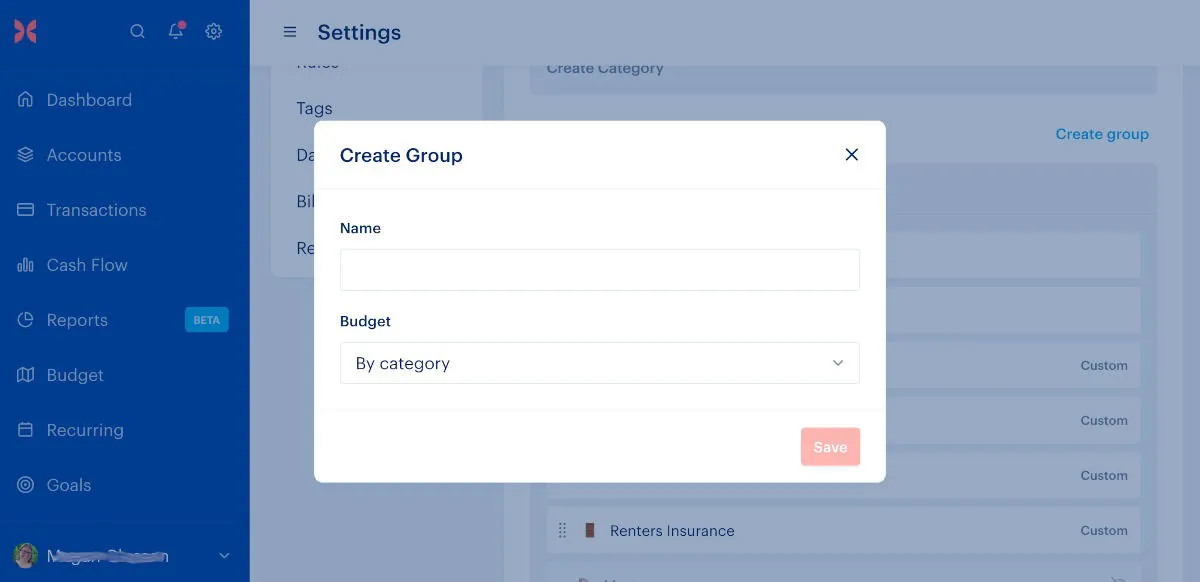

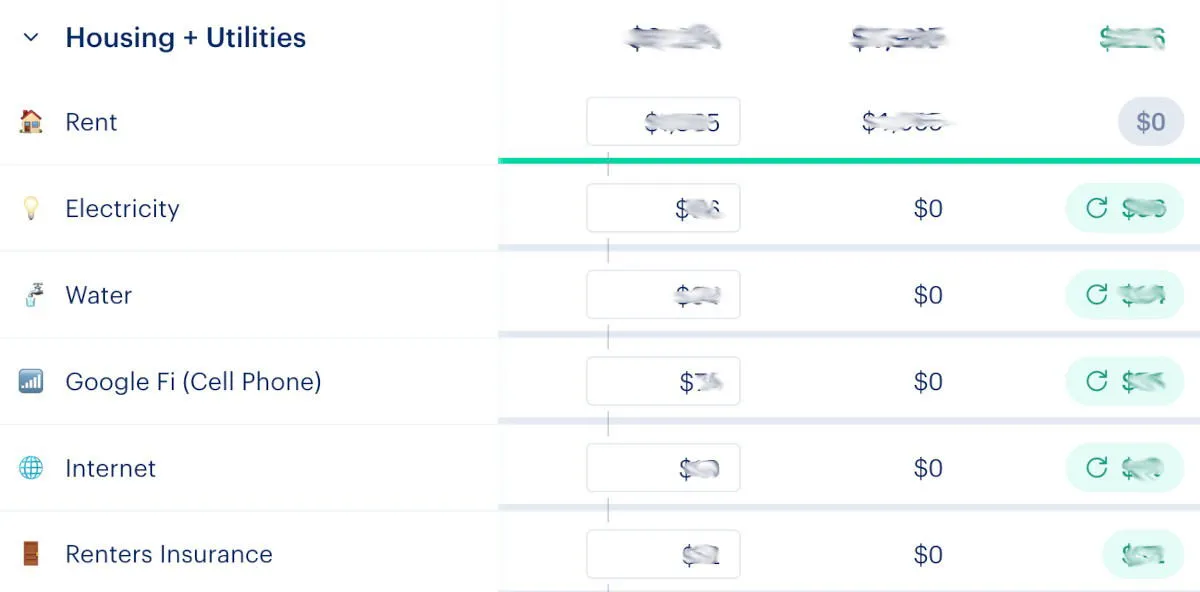

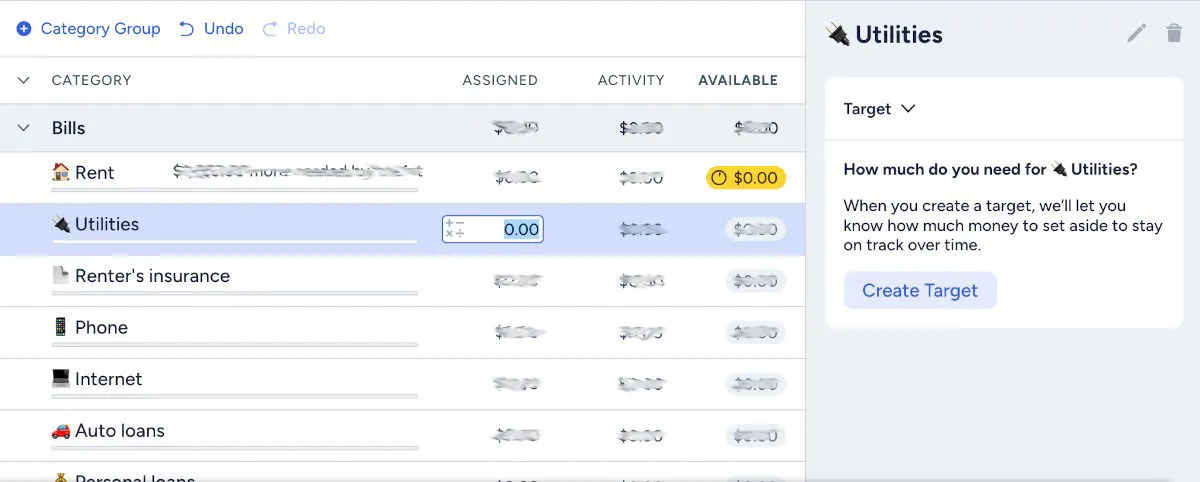

The app’s budget categories are highly customizable—I can add numerous budget line items, enabling me to break down categories into more manageable segments or keep them broad.

For example, I’ve created a budget group centered around Health and Wellness, which includes categories for Physical Health, Mental Health, Medications, Self-Care, and Pet Care. This organization allows me to track my health-related expenses and differentiate between necessary and optional spending, like therapy visits versus massages.

Additionally, I can adjust categories and budget allocations as needed, making it easy to save for annual expenses, such as property taxes, or to accommodate fluctuating seasonal categories, like clothing purchases.

Variety of Views

Similar to Mint, the Monarch app features an account overview dashboard to display all accounts at a glance. This feature simplifies comparisons between incoming and outgoing funds and illustrates assets versus liabilities and total net worth. Users can also access individual account details without logging into multiple platforms.

In addition to the general overview, Monarch provides a detailed monthly budget view, categorizing income and expenses. This view includes visual indicators for each category, helping manage spending, particularly for groceries, fuel, and discretionary funds.

Moreover, the app features a transaction view that displays daily transactions, allowing users to categorize each one or verify their transactions against physical receipts.

Collaborative Budgeting

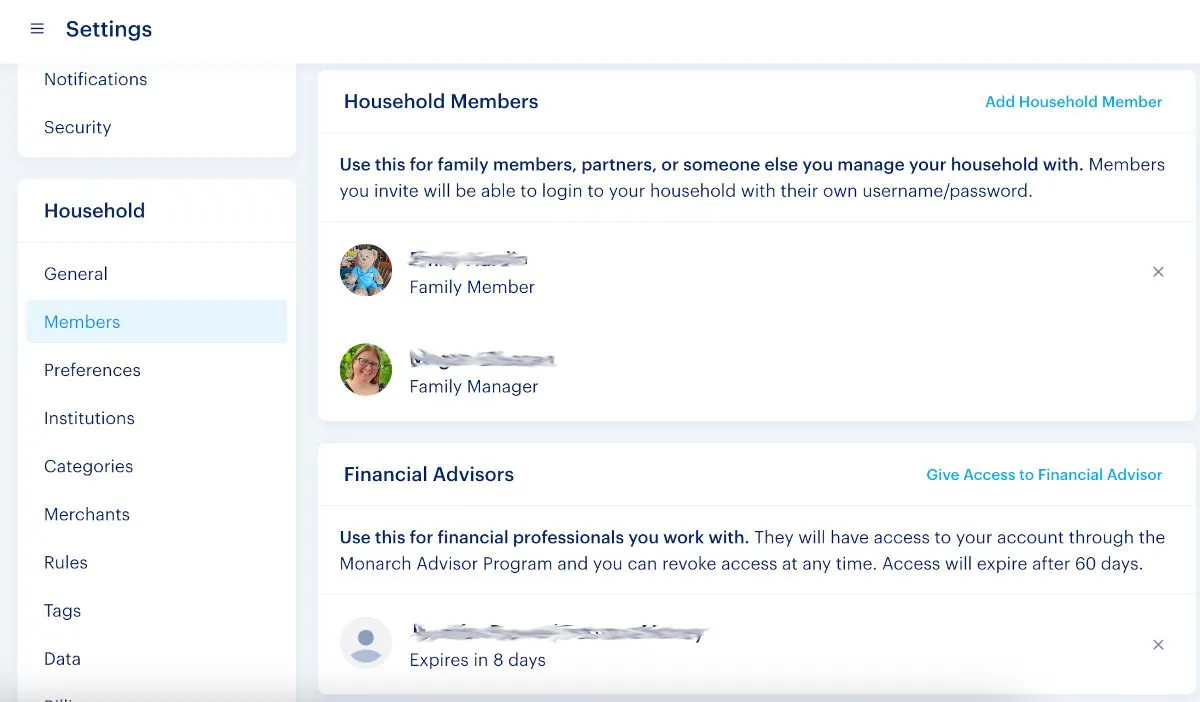

Monarch demystifies financial discussions for couples by allowing them to share as much or as little information as they wish. By sending an email invite to my partner, she created her username and password to access the app, ensuring transparency about spending habits.

Additionally, as I regularly consult with a financial coach, Monarch’s Advisor program gives me the capability to share my data with a certified financial planner while restricting what they can see. This access is renewed every 60 days, offering privacy and security if I decide to change financial planners.

Comparing Monarch to Other Mint Replacements

As a tech product reviewer, I explored multiple Mint alternatives to ensure I selected the best budgeting app for my financial planning needs. I compared Monarch against other popular apps, specifically Copilot and YNAB.

Monarch App vs. Copilot

Although both Monarch and Copilot exhibit similarities in expense tracking, I encountered issues with Copilot that hindered my experience. Currently, it only supports Apple devices, limiting usability for those on Windows or Android platforms.

Copilot’s sole focus is on tracking spending, neglecting income management like Monarch does. This necessitated maintaining a separate income spreadsheet for my freelance work and full-time job, adding complexity to my budgeting process and preventing timely overspending alerts.

Consequently, I moved away from Copilot after a few months.

Monarch App vs. YNAB

YNAB was another contender for a Mint replacement due to its popularity; however, its rigid structure posed significant challenges for my budgeting needs.

My primary concern was YNAB’s limited customization options. Unlike Monarch, which allows personalized setups, YNAB’s approach to budgeting is quite inflexible. I was unable to transfer my established budgeting system from Mint to YNAB.

Additionally, YNAB emphasizes daily cash flow over debt management and savings, which was a central focus of my budgeting efforts.

Though I was initially disappointed to lose Mint, I am grateful to have found the exceptional Monarch app as its alternative. Personal finance apps have streamlined my financial journey in ways that mirror the transformative experiences of fellow writers.

Image credit: DepositPhotos.

Leave a Reply