Free Ways to Check Your Credit Score Online: Top Websites

Your credit score plays a significant role in various aspects of your financial life, yet often, this information is secured behind paywalls. Did you know that there are reliable platforms where you can check your credit score at no cost? The websites listed below not only let you access your score for free but may also provide resources to help manage your financial situation more effectively.

Important Tips Before Using Any Credit Reporting Service

It’s essential to remember that any website offering access to your credit report and scores will require your social security number for identity verification. Always stay vigilant for indications of fraudulent sites before sharing your personal details. Should you receive unsolicited emails or texts prompting you to enroll, it’s advisable to avoid clicking on those links and instead, navigate directly to the website.

1. Credit Karma

Score Updates: Daily updates from TransUnion and Equifax

Credit Karma is arguably the most popular platform for free credit score checks and is my personal favorite. The site generates revenue by displaying credit card offers tailored to your current credit scores and through various advertisements. From my experience, the dashboard tends to overwhelm with promotional content, but if you’re not in the market for loans or credit cards, you can easily navigate to your scores directly.

In addition to credit scores, Credit Karma provides:

- Custom recommendations for credit cards, loans, and insurance

- Identity theft monitoring

- Tax assistance resources

- Financial guidance based on your scores

- Financial calculators

- A detailed guide on credit score calculations

- Apps for iOS and Android

2. NerdWallet

Score Frequency: Weekly updates from TransUnion

For a deeper grasp of your finances, NerdWallet is an exceptional resource. With side-by-side comparisons and expert advice at your fingertips, it’s an excellent tool for enhancing your credit and saving strategies. Personally, I appreciate the access to my TransUnion score for free.

The features of NerdWallet extend beyond credit scores to include:

- Tracking of income and expenses

- Customized financial suggestions

- In-depth educational resources/articles

- Investment advice

- iOS App and Android App

While I find that NerdWallet provides a wealth of financial information compared to Credit Karma, the recommendation system can be quite aggressive. Nevertheless, I strongly suggest reviewing their tips and advice for improving your financial health.

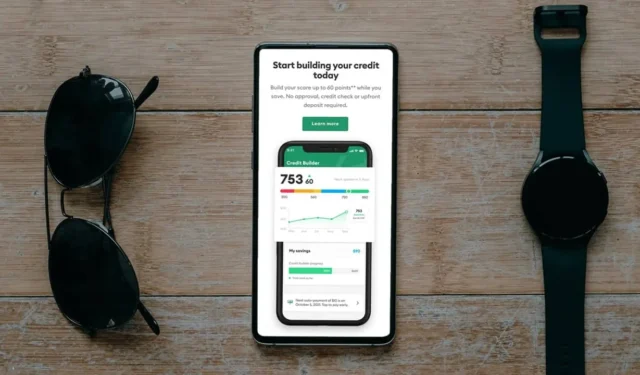

3. Credit Sesame

Score Updates: Daily updates from TransUnion / Starting at $9.95 monthly for Equifax and Experian access

Credit Sesame focuses on helping you comprehend and enhance your credit profile, and it offers free access to your credit score. A standout feature is its use of AI to analyze and clarify your credit report.

Beyond providing a free credit score, Credit Sesame offers:

- A Credit Sesame grade for better insight into your credit

- Personalized recommendations for financial products

- Custom advice to improve credit profiles

- Alerts for any credit changes

- iOS App and Android App

However, while some services are complimentary, others, like certain credit-building features, require payment. The comprehensive nature of Credit Sesame’s services doesn’t quite match those offered by its competitors. Additionally, details about premium options remain hidden until you create a free account.

4. WalletHub

Score Updates: Daily updates from TransUnion

WalletHub ranks among the best websites to check credit scores at no cost. It offers personalized financial recommendations (including credit cards and loans) while allowing free access to your credit reports. There’s no obligation to sign up for any paid services beyond the complimentary option.

WalletHub offers free basic credit monitoring and includes:

- Alerts regarding credit changes

- Daily personalized credit suggestions

- In-depth reviews of lenders

- WalletScore to enhance your understanding of credit reports

- iOS App and Android App

While some offerings like identity theft protection, address tracking, and dark web monitoring come with a fee, starting rates are as low as $6.49/month, which is reasonable for identity monitoring.

5. Credit.com

Score Updates: Bi-weekly updates from Experian / $25 per month for access to all three credit scores

Credit.com aims to assist in improving your credit. It’s noteworthy that they offer free access to Experian over TransUnion, which is beneficial since scores can differ across bureaus.

The site also provides:

- Guidance on credit improvement

- A credit report card to help comprehend your score

- Custom offers for loans and credit

- iOS App and Android App

- Premium credit-building services

Credit.com features one of the most extensive premium packages available. For $25/month, you gain access to all three primary scores, FICO scores, identity monitoring, credit enhancement resources, and more.

6. CreditReport.com

Score Updates: Weekly updates from Experian and FICO

CreditReport.com, a site owned by Experian, is a straightforward option that is completely free. Although it is simpler than many others on this list, it effectively provides your FICO and Experian scores. Keep in mind you can also register with Experian to access similar information at no cost.

While CreditReport.com is limited in offerings beyond scoring and reporting, it provides:

- A clean interface free from ads or distracting credit card promotions (my favorite aspect)

- A comprehensive Experian credit report (as opposed to simplified views on some sites)

- Basic educational resources/articles regarding credit

Though Experian has mobile applications, CreditReport.com doesn’t, and it lacks extensive resources on credit education or report interpretation.

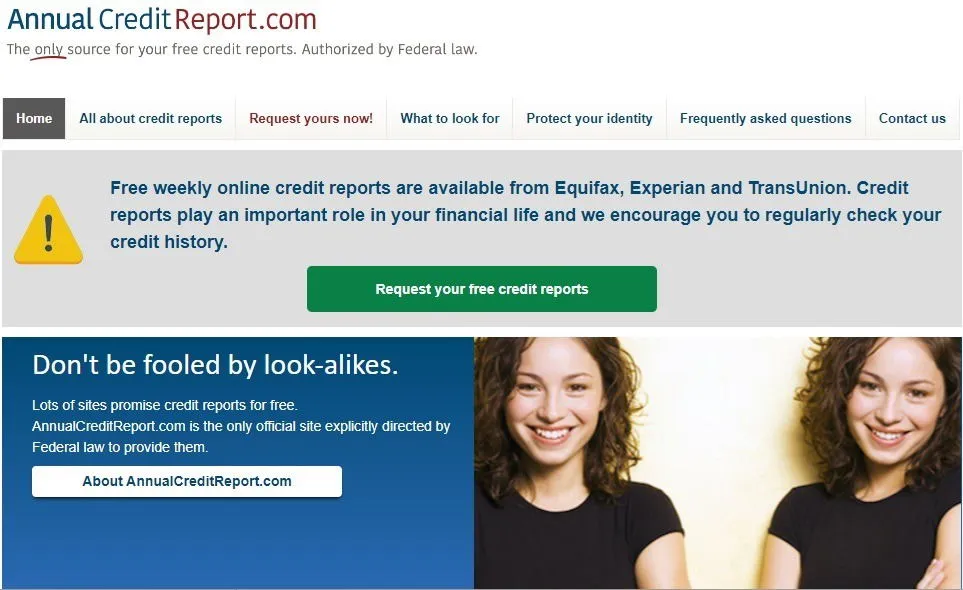

7. AnnualCreditReport

Score Updates: Weekly updates from Experian, Equifax, and TransUnion

AnnualCreditReport is the sole site granted authorization by the federal government to supply consumers with complimentary credit reports. While other sites can be trusted, this one is government-sanctioned. I recommend utilizing this portal alongside other resources from the list to gain the most comprehensive view of your credit status.

AnnualCreditReport is the exclusive source for obtaining all three major credit reports at no charge.

- Resources for credit improvement and financial literacy

- Insightful details on credit report comprehension

- Access to full reports instead of mere scores

The downside is that the credit reports may not always include your score, but generally, positive report findings correlate with healthy scores.

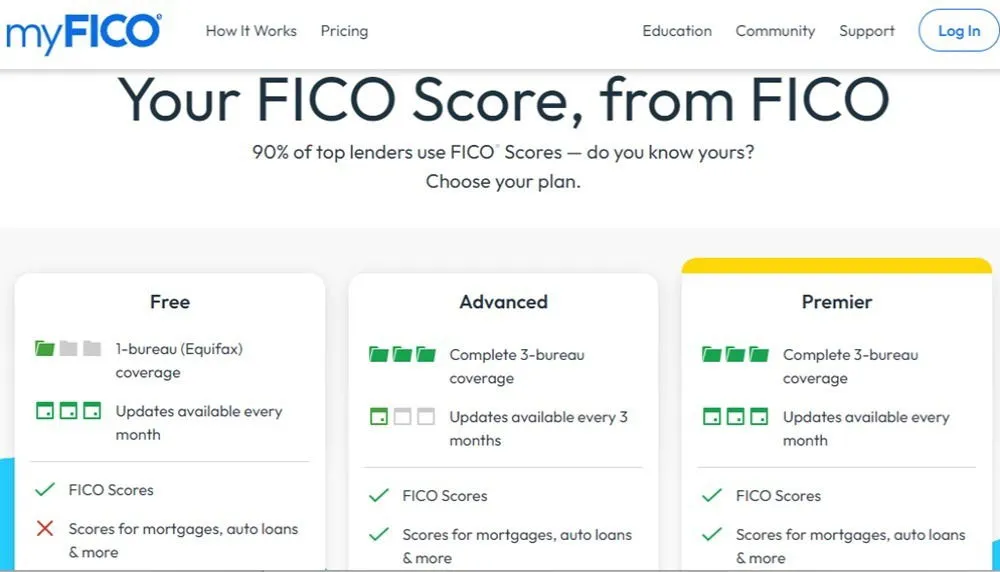

8. myFICO

Score Updates: Equifax

myFICO is primarily recognized as a premium service; however, it also provides monthly Equifax credit scores for free. As indicated in its name, it offers FICO scores as well.

This free service is rather basic, providing only:

- Your Equifax score and credit report

- Your FICO score

- Monitoring for any score changes

Financial literacy materials are limited as well. For premium members (starting at $30/month), you gain access to scores from all three bureaus, identity monitoring, insurance, and loan-related scores.

9. Credit Card Providers

Some credit card companies allow you to check your credit scores at no charge. One provides an Experian score while another gives you a TransUnion and FICO score. There’s no cost associated with this service, and both options offer free dark web monitoring to alert you if your information has been compromised.

Should you hold credit cards, check whether your issuer offers free access to credit scores; generally, you’ll need to access this via a desktop site rather than a mobile app. It’s a convenient and cost-free option. Don’t forget to check with your bank as well; while not all banks provide this service, some do.

To enhance your credit health, tap into the insights and tips provided on these platforms. Additionally, consider using budgeting applications and Notion budget templates to keep your finances on track.

Image credit: Unsplash. All screenshots by Crystal Crowder.

Leave a Reply